How to Finance Your Dream Career Without a Mountain of Debt

If you are beginning your collegiate career right out of high school that can be a magical time, especially for a young woman. The social climate currently really advocates for women to make it happen and dream big in terms of their career choices and presence in the professional arena. Having the drive and smarts to get you going is important, but you also need to have the funds to finance your dream career.

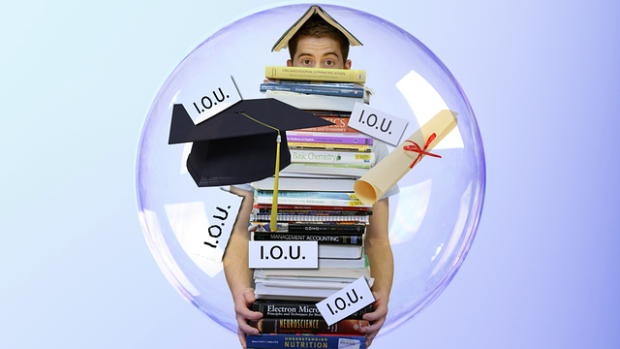

For a lot of women, funding their education and subsequent career can be just as important as participating in it. The pride that comes from having reached your goals on your own terms is incredibly satisfying. Since it is likely that you will be using student loans to help you build this life for yourself, plan ahead using some easy tips and tools so that once you have your diploma in hand, all you have to worry about is cementing your footprint on your chosen profession.

Where to Start

Once you have determined most of the fixed costs regarding your education, you can determine the size loan that makes the most sense for you. Consider what you can afford out of pocket, and what beyond tuition and books you need this loan to cover. This is also the time to think about what repayment is going to look like. Your inevitable salary will have no bearing on your monthly payment, so you need to use a student loan repayment calculator to estimate what your monthly payments may be with a private student loan. This going to be a good figure for you to keep in your mind when you determine your total borrowed amount.

Staying ahead of any potential issues with repayment will allow you peace of mind when you are navigating the job market as well. You will feel more empowered to make a decision based on the job you want, and the company you want to work for, versus the salary that you have to earn to manage your debts. However, it is likely that throughout the length of your loan, your financial situation will change as you advance in your career. A student loan refinance calculator is another helpful tool that can paint a general picture of what your responsibilities will look like as your life transitions.

Take on a Side Hustle

This is a great suggestion because it is customizable. Many students do not have the time to work, and also dedicate themselves to their studies, but taking on a part time job, with flexible terms and conditions can help you earn some cash that you can actually start stashing away little by little to allocate to your student loans post-graduation. Get creative with ways to make money and take advantage of the breaks in classes where you do not need to focus on school.

Seasonal retail work, dog sitting, weekend childcare, these are all nontraditional sources of income that do not pigeonhole you into a potentially stressful situation trying to balance your studies and your side hustle. Start a no minimum, low risk, out of sight, out of mind savings account and have your income from your side hustle filtered directly into it, and dedicate yourself to not touching it until the time comes to start paying back your lender. Not counting on this cash, but having it, also creates somewhat of a safety net for you in case of an emergency, you can be assured that you will still have some money to allocate to your debt even in times of struggle.