My Spouse Filed for Divorce — Now What?

It’s been a hard day at the office. You arrived early, stayed late, and handled a slew of meetings in between. As soon as you get home, you notice a bulky certified mail envelope. Your day just took a turn for the worst as you realize, in no uncertain terms, that the documents you’re holding are divorce papers sent by your soon-to-be ex-spouse.

You’re not alone if you’re thinking, “My spouse filed for divorce, now what?” The U.S. is among the top 13 countries with the highest divorce rates. However, the immediate answer to this question is nothing. Divorce can be incredibly shocking, traumatizing, and emotional, and you don’t want to make rash decisions that could hurt you in the long run. Take some time to talk with a friend, family member, or therapist before making any significant decisions. In other words, take a breath.

Once you cool down enough to start thinking clearly, it’s time to figure out next steps. Specifically, you need to plan for your financial future post-divorce. If you’ve received a divorce letter or divorce papers, here are a few important guidelines to keep in mind to preserve your financial well-being:

Take inventory of your assets.

First, you need to know what assets you have. You can’t ensure you’re getting your fair share if you don’t have a comprehensive understanding of what you own.

And even if your spouse is not manipulative or abusive, they could start moving assets. Without a full picture of your current assets, you would never know. It’s important to note that any asset you acquired during your marriage is subject to being split in the divorce settlement. In some states, this is known as community property.

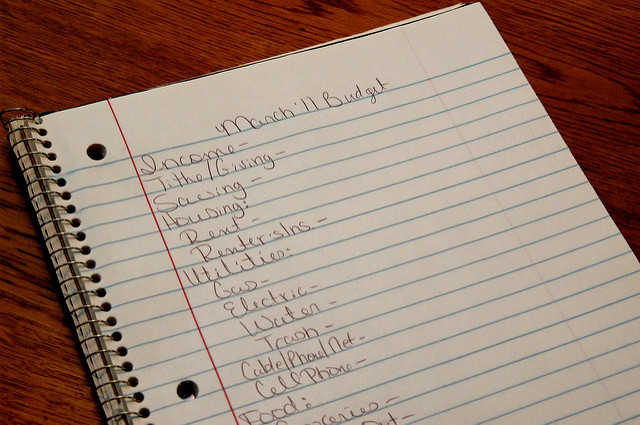

Determine your post-divorce budget.

After you’ve taken inventory of your assets, now is the time to focus on your post-settlement, or post-divorce, budget because your bills will likely increase. If you are not the spouse who typically pays the bills, you need to figure out the true costs of running the household and understand those costs before going into a divorce settlement.

Calculate your budget as accurately as possible at the outset of the process so you ask for enough resources during the divorce settlement. To ensure you are accounting for all your assets and expenses, consider working with a financial advisor who can provide some guidance.

Another item to consider in your post-divorce budget is taxes. You will likely be moving from “Married Filing Jointly” to “Single” filing. If you were the breadwinner in the relationship, this would probably hurt you financially. If you weren’t making as much as your spouse, however, this might not affect you.

Also, if your spouse pays child support or alimony and something happens to them, this could derail your finances. To prevent this impact, think about getting a life insurance or disability policy on that person (as well as yourself) if you have dependents.

Lastly, it’s crucial to think about Social Security and spousal benefits and how divorce impacts them. You can still receive half of your spouse’s retirement benefits if you were married for 10 years, divorced for two years, at least 62 years old, and not remarried. If you’re married, however, you can only get spousal benefits if you take out your own retirement benefits. This is more flexible with divorce.

Split your assets thoughtfully.

Once you have a concrete understanding of what you own and what your post-divorce budget will look like, it’s time to split the assets. When the legal process begins, consider mediation. It’s a lot less expensive to hire a mediator — a neutral attorney who can help make your divorce an amicable separation — rather than both parties hiring divorce attorneys. A mediator can help you split assets evenly and fairly.

There are three very important considerations when splitting assets: liquidity, taxation, and appreciation. Asset liquidity refers to how fast you can convert an asset to cash. It’s common for people going through divorce to become heavily attached to certain assets, such as their homes. But it’s critical to remember that not only is your house an expensive asset (requiring a lot of cash outflows for maintenance, repairs, etc.), but it’s also not liquid. Should you run into an emergency, you cannot quickly convert your house to cash.

Another characteristic of an asset is its taxation. All assets are not taxed equally. For example, with a traditional IRA or traditional 401(k), you get an up-front tax deduction. However, when you distribute the money later, it is taxed as ordinary income.

Roth IRAs and Roth 401(k)s are the opposite; you don’t receive a tax deduction for the contribution, but when you distribute the assets, you pay no taxes. For a brokerage account, you pay taxes on the investment income, as the stock or mutual fund pays them each year. You’re also taxed on any capital gains after selling. Long-term capital gains and some investment income are taxed at preferred rates (over ordinary income rates).

When splitting assets, be sure you aren’t left with only the traditional IRAs or 401(k)s while your spouse takes all the Roth assets. It’s ideal to have a mix of assets with various taxations. This will allow you to do tax planning with your assets down the road.

Lastly, consider the growth potential of each asset. A house typically increases around 3% per year, whereas accounts invested in the market (e.g., IRAs, 401(k)s, and brokerage accounts) have the potential to grow much more. Many women opt for the house due to nostalgia and convenience. But from a financial perspective, it’s very illiquid, typically doesn’t increase in value quickly, and can be a money pit. These are all essential things to keep in mind when splitting assets.

After splitting assets, be sure to update your beneficiary designations and your estate documents, such as powers of attorney and healthcare documents. After all, you probably don’t want your ex-spouse inheriting your retirement accounts or making financial decisions for you.

Post-Divorce Mistakes to Avoid

There are many things to do after a divorce. But there are also some important things not to do. Divorce can be incredibly traumatic, stressful, and emotionally charged. As a result, it can feel tempting to engage in certain activities or behaviors that seem helpful in the moment but might hurt you in the long run.

To start, avoid hiding assets. If your spouse feels you are hiding things, they, too, might try to conceal assets. It doesn’t matter what you think is fair; your credibility is more important. Being honest gives you and your soon-to-be ex-spouse the best chance of settling civilly.

Also, avoid badmouthing your spouse to your friends and family. This is especially true when interacting with your children. Remember, your credibility is everything in the divorce process, and badmouthing your spouse puts several things at risk — including custody rights — even if the statements you make are true.

Finally, though this should go without saying, avoid social media during the divorce process. Again, badmouthing a spouse on social media can be held against you. So can bragging about a new, big purchase. When you post on social media, it’s public and never goes away.

Overall, it’s important for you to understand your financial situation before something happens, whether it be divorce or death. It’s very difficult to cope and get your finances in order when it feels as though everything is falling apart.

This guest post was authored by Sara Gelsheimer

Sara Gelsheimer is a senior wealth manager at Plancorp, a full-service wealth management company serving families in 44 states. Sara came to Plancorp with a strong financial background and a commitment to financial education, particularly for women. With this passion, she founded InspireHer: Plancorp’s Women’s Initiative, which inspires financial confidence in women through education and impactful support. By giving women a comfortable space to learn and ask questions, she strives to empower them to be more confident in their financial lives. She has a passion for helping others and has spent several years as a mentor through a local nonprofit, sponsors two young women in Uganda, and is on the parish council at her church.

Disclosure: This material has been prepared for informational purposes only and should not be used as investment, tax, legal, or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal, and accounting advisors.

******

Ms. Career Girl strives to provide valuable insights you can use. To see more from our columnists and guest authors, check these out! Or subscribe to our weekly email featuring our latest articles. We’re also present on Medium!