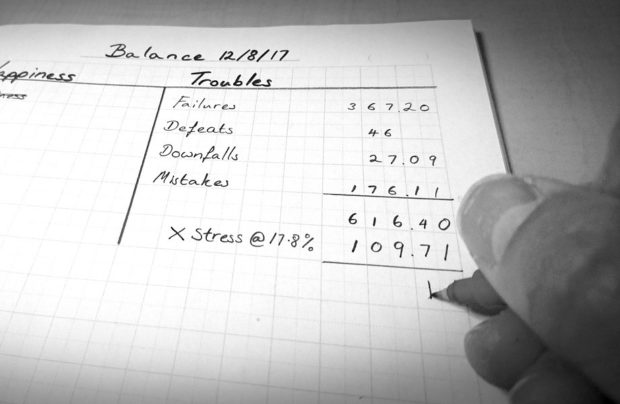

Psychological Tools That Help Overcome Debt Stress

Nobody said that dealing with debt stress was easy. When you owe money, there are all sorts of thing floating through your mind. Will your home be repossessed? Will you have to move? Will you be able to feed yourself and your kids?

Fortunately, there are a number of well-established psychological tools which can help you face up to your financial problems and sort them out before they stress you out so much they rob your capacity to find solutions.

Health researchers are finding increasing evidence that money worries take their toll on our health as well as our finances. People who are stressed out about things like money experience accelerated brain aging. Multiple episodes of money related stress have been associated with having a brain seven years older than it actually is. The bottom line? Struggling with debt is bad for your health, and you should do something about it. Here’s how.

Gain Some Perspective On The Importance Of Money

According to psychologists at the University of Houston, the things in our life to which we ascribe the greatest meaning stress us out the most. For instance, people tend to get stressed out about their work, relationships, and money because they see these things as central to what it means to have a fruitful and happy life. Without these, many people just assume that they cannot be happy.

But when most people think about money, they usually come to the conclusion that it’s not the money itself that makes them happy or improves their mood – it’s something else. Usually that “something else” is the need to be perceived as successful or the need to provide for a family. But the numbers flowing in and out of your bank account are rarely the deciding factor. Psychologists, therefore, recommend that people downsize and reevaluate their priorities. Do you need to go on a foreign holiday every year, or would a trip inside the state suffice?

Give Your Self-Control A Workout

Financial pressures and declining incomes aren’t the only reason people experience debt stress. Often they just don’t have any restraint. If they see something that they want, they buy it and figure out the consequences later. Unfortunately, this approach often leads to disaster, especially if your income isn’t rising in line with your lifestyle.

Self-control, according to psychologists, is a muscle. If you don’t use it, you lose it. That’s why top psychologists, like Roy Baumeister from Florida State University, recommend that people dedicate their mental energies and self-control to tasks which help pay down their debts. This includes things like avoiding browsing shopping websites late at night and taking routes home from work that don’t bypass your favorite shopping mall.

Don’t Medicate With Spending

When some people feel down, they spend money to cheer themselves up. The result is mounting debt and even more pressure on your finances in the future. Rather than embracing the impulse to spend and acting on it, psychologists recommend refocusing on the things that really matter in your life, like relationships and hobbies to divert your attention.